Taking a Calculated Approach to the Off-Premises Revolution

A shift in how consumers eat out

The off-premises dining market is enormous, and it’s not going away.

Options such as fast-food drive-thru and phone-in pizza orders have long been around, but 2020 made everyone realize how critical an off-premises strategy is. Convenience with a focus on safety and consumer's increasing comfort level with technology have driven demand higher. Now that consumers have tasted the convenience of third-party delivery services and touchless deliveries by restaurant staff, it doesn't appear restaurants will be returning to the pre-COVID levels of off-premises dining.

Weighing the benefits and costs of off-premises dining

Restaurants benefit from getting stomach-share of customers who perhaps would not have come in. With dining space real estate still spread out in some areas, re-staffing challenges, and some diners not yet ready to dine-in, restaurants can potentially reduce costs and replace lost revenue with a realistic off-premises strategy.

But there are other considerations restaurant finance teams need to make. How will food be packaged or prepared for its journey, and how will that affect the cost of goods sold? Should your restaurant opt for third-party delivery, keep it in-house, or do a mixture of both? Off-premises options can also introduce less predictable demand, which can hit prime costs with waste and staffing challenges.

Competition is fierce, and customer expectations are high, putting added pressure on the back-office. Here are four ways finance and accounting teams can take a calculated approach to tackle off-premises dining.

Ensure line of sight across your business

An integrated, best-in-class financial management system serves as a central hub of information.

Many operators have their point-of-sale (POS) systems integrated with the financial management platform for real-time data visibility with minimal effort and errors. With delivery aggregators increasingly integrating with POS systems or operators opting to keep the ordering in-house, integrating the POS systems with the financial platform makes sense. A cloud financial management platform like Sage Intacct® is the hub of transactional information in a fully integrated ecosystem. The restaurant can fully leverage reporting and dashboarding capabilities with real-time data to measure profitability, demand, and ideal price point – all while minimizing error-prone data rekeying.

Track the effects of your channels

Dimensional custom reporting should capture information as quickly as your business conditions change.

By partnering with third-party delivery aggregators, not only do restaurants save on the costs of driver fleets, but they also expand their reach to customers who may not have been regular diners. In deciding whether to opt for in-house delivery, restaurants must examine if the added labor and technology costs outweigh third-party fees. Restaurants need tools to take a data-driven approach and understand the mix that works for them.

Sage Intacct's dimensions and custom reporting enable you to analyze the performance of cost and revenue drivers and quickly understand what's working and what's not. With rolled-up summary views of entities at any time, you maintain visibility of program performance in various locations to gauge different customer behavior and price points.

Keep a handle on indirect costs

Got a ghost kitchen strategy? Streamline how you get insights on performance.

Ghost kitchens, which solely produce food for off-premises orders, are growing in adoption as an offshoot of the off-premises trend. These facilities serve to reduce the strain of added delivery orders on a restaurant's kitchen. Or they're a way to help restaurants test new concepts without the typical costs of highly trafficked location rent and equipment.

But the costs associated with ghost kitchens are not as transparent as the name implies. Sage Intacct's Dynamic Allocations capabilities can help restaurants understand their actual business performance in complex scenarios. For example, a business that runs several delivery brands from a single ghost kitchen. Calculating complex cost allocations, creating journal entries, and troubleshooting can take one to two days per month when done in spreadsheets. Automating the cost allocation of overhead (membership fees, marketing expenses, and non-hourly wages) saves time and gives the ability to get a more accurate understanding of the profitability of each brand. When you simplify the steps to getting insights, you can make dynamic, informed decisions.

Monitor revenue behavior with automated daily reports

Spend more time as a forward-looking strategist rather than a financial historian.

Third-party delivery services help restaurants reach customers they otherwise would not have. But these bring service fees that can range between 10-30% of orders. Contract terms with third-party services dictate how restaurants should account for their sales and fees. Throw loyalty programs into the mix, and restaurants have new revenue recognition standards to grapple with.

Only with the visibility of current information can restaurants find ways to ensure profits, such as higher prices on delivery items, delivery surcharges, or unique delivery menus. Sage Intacct simplifies revenue recognition challenges through automation, allowing you to spend less time creating reports and more time on analysis and strategy.

What's next with off-premises?

As customer appetite for convenience increases, the restaurant industry will continue to evolve as well.

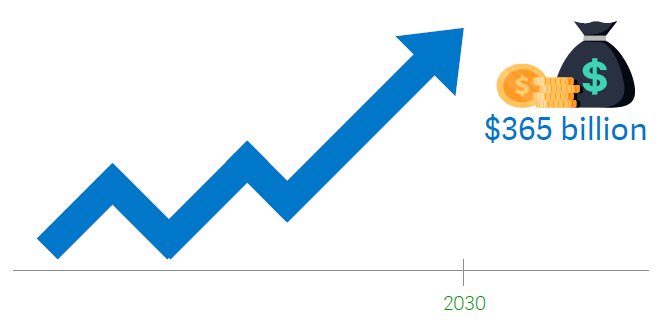

Before COVID, estimates were that the global online ordering market would grow tenfold over the next decade, to $365 billion in 2030.1 We might very well get there before 2030. Off-premises ordering is here to stay and will only keep growing. In an increasingly complex business environment with various off-premises models, restaurant finance teams need modern, connected technology to ensure they are taking a data-driven, calculated approach to grow their off-premises business.

1 USB, "Is the Kitchen Dead?" 2018

Flexibility and automation so you can adapt and thrive

Challenges lie ahead in tracking the added revenue streams against new costs. Sage Intacct provides the tools to understand restaurant performance in complex scenarios so you can set your restaurant business up for success in driving customer satisfaction, even as business conditions change.

To learn more about how Sage Intacct can help you achieve your mission more efficiently, fill out the following information and DeRosa Mangold will be in touch.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

If you would like to take a quick look at the software, you can take part in one of the daily Coffee Break Demos we offer.