Survey: Sage Intacct Tops NetSuite in Market Share Among SaaS Customers

Sage Intacct is the number one financial management solution for fast-growing SaaS companies that have upgraded from, or entirely avoided, entry level solutions such as QuickBooks and Xero.

That’s according to a new independent survey.

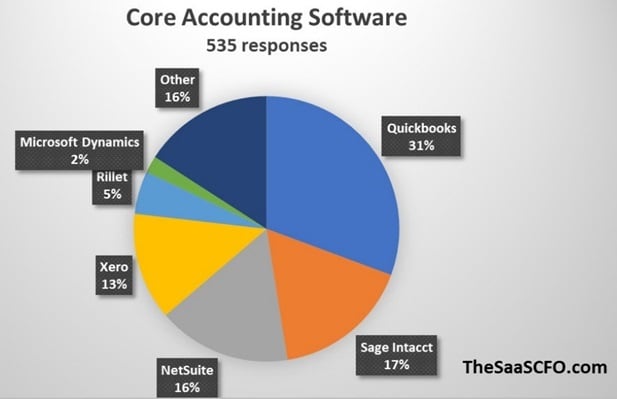

The 5th Annual Tech Stack Survey from The SaaS CFO, a consultancy headed by industry expert Ben Murray, reveals that Sage Intacct has 17% market share for core accounting among 535 SaaS companies.

That’s ahead of competing midrange solutions such as Oracle NetSuite and Microsoft Dynamics.

It also builds upon Sage Intacct’s market share leadership in previous surveys.

QuickBooks remains the dominant application with 31% market share — yet its sweet spot is smaller companies with $10m or less in annual revenue.

For the next generation of growing companies with revenue of $11m to $50m, Sage Intacct is the market share leader.

To compare Sage Intacct and NetSuite head-to-head, The SaaS CFO data shows Sage Intacct with higher market share than NetSuite among this cohort of scaling companies with revenue from $1m to $50m, comprising 61% of survey respondents.

Market Leadership in AI, Invoicing, Rev Rec

As the head of the SaaS/software vertical at Sage Intacct, we’re highly gratified that these results align with what we often hear from SaaS customers: “While NetSuite may have been around longer, Sage Intacct has the better solution for SaaS companies.”

A key reason: Sage Intacct offers the most complete financial platform for SaaS companies, leveraging artificial intelligence (AI).

Beyond core accounting, we deliver essential functionality such as usage billing, invoicing, revenue recognition, close management, SaaS metrics reporting, AP automation, and payroll.

Regarding AI, what we routinely hear is the finance leaders want to make smarter, faster decisions that are not just better informed, but forward-looking, giving you the edge.

For that reason, Sage AI not only automates routine tasks such as invoice processing to boost productivity.

It also provides a dynamic, up-to-the-second view of your business performance, and sifts through your data mountain to uncover patterns, transforming them into valuable insights that unlock actionable options at your fingertips.

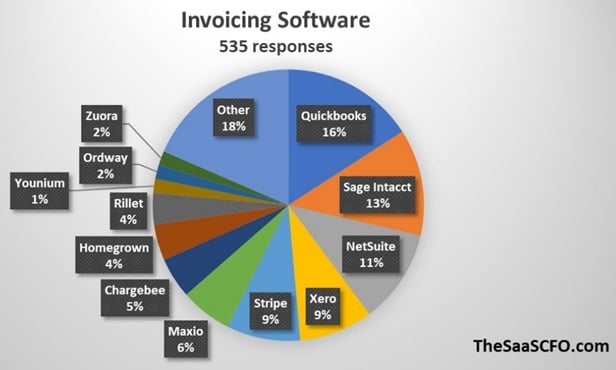

To that point, as The SaaS CFO chart below shows, our invoicing software holds a strong 13% market share, just behind QuickBooks and ahead of NetSuite.

Many Sage Intacct customers use invoicing in tandem with our revenue recognition solution to eliminate manual work, streamline order-to-cash, comply with ASC 606, and generate data for SaaS metrics reporting.

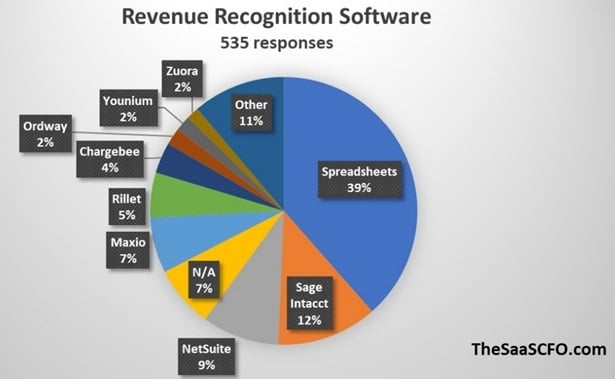

That makes us the number one dedicated rev rec solution, though 39% of companies surveyed labor ahead with spreadsheets.

For companies that prefer a best-of-breed approach to building their tech stack, the Sage Intacct Marketplace offers a wide range of options from trusted Sage Intacct partners that can be readily integrated through our straightforward API.

Sage Intacct partners or integrate with many other products in The SaaS CFO survey, such as:

- Chargebee

- Ordway

- Stripe

- PayPal

- Authorize.net

- Vena

- Planful

- Jirav

- Expensify

- Ramp

- Concur

- Airbase

- Brex

- Avalara

- Anrok

- Tableau

- Domo

- Salesforce

- HubSpot

- FloQast

- Numeric

- Mavenlink

- BigTime

- ADP

- Gusto

- Rippling

- Paylocity

- Bill.com

- Spiff]

- AmEx

- Divvy

- Power BI

- ChurnZero

- Versapay

- Tesorio

… and many others.

In addition, strong controls in Sage Intacct help ensure financial data integrity on the path to going IPO —vital especially in securing funding and, for companies going public, achieving compliance with SOX and third-party audit standards.

That’s critical for customers such as CoreCard, a public payment card management platform provider based in Georgia.

Public company CoreCard switches off a suite to scale globally

As a growing public company, CoreCard (NYSE: CCRD) needed robust public market reporting, strong SOX compliance, and seamless global consolidations across its US and international operations.

Previously running a legacy Sage 50 system, CoreCard first migrated to a suite.

That move didn’t work out as planned.

“We had a lot of problems getting the functionality we needed, and the implementation was a challenge,” says Matt White, CoreCard CFO.

“We didn’t get the support we needed, and we weren’t able to utilize the global consolidations or multicurrency conversion functions.”

Matt adds, “We went back to Sage and decided to go with Sage Intacct — which we should have done all along.

“Sage Intacct is intuitive and powerful, so we can consolidate and close faster, and report and comply as a public company.”

With Sage Intacct, CoreCard has gained capabilities such as an intelligent general ledger, public market reporting, foreign currency management, consolidations, and SOX compliance to help it thrive as a public company.

“Sage Intacct is a lot more intuitive versus the other cloud platform we tried,” says Matt, named CoreCard’s CFO after previous roles at Equifax, Humana, and Deloitte.

“You can use Sage Intacct without hours and hours of prior training.”

After rapidly scaling up his team on Sage Intacct, Matt says time needed for global consolidations has dropped from two days to one minute.

And they’re able to incorporate foreign exchange into those calculations.

“With Sage Intacct, it now takes minutes,” says Matt. “There’s a big benefit to having all our subsidiaries in one accounting system, and using the consolidation function to consolidate more efficiently.”

CoreCard strengthens reporting and SOX controls

Fast, accurate reporting and built-in controls with Sage Intacct are also helping CoreCard strengthen SOX compliance and generate new business insights — all while minimizing spreadsheet work.

“SOX compliance is always top of mind, so you want to make sure you’re using the best security controls and reporting,” says Matt.

“With Sage Intacct, we have a much more automated process and the confidence that our results are accurate.”

CoreCard augments its Sage Intacct accounting platform with Sage Intacct Budgeting and Planning, gaining new FP&A capabilities that it lacked in Excel.

This allows it to have more predictable forecasts and expense management for its reporting as a public company.

Those same capabilities have also helped others businesses create $67b of market capitalization with IPO readiness and the transition into public companies.

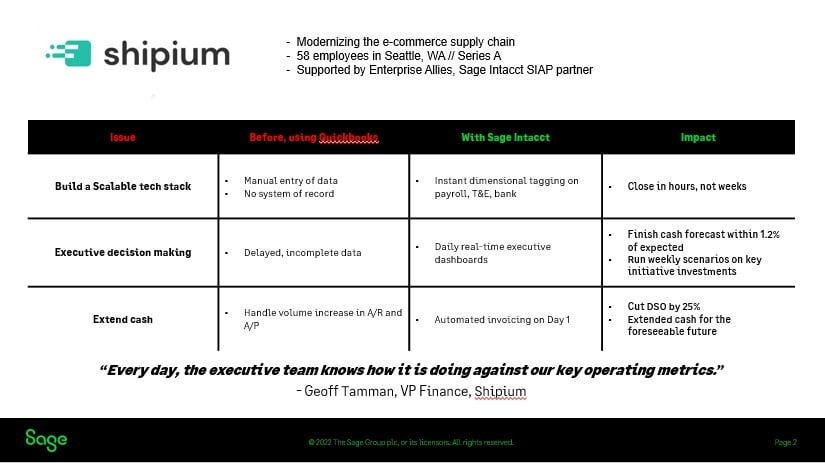

But it’s not just large companies making the switch — fast-growth early stage companies such as Shipium as also part of this market momentum.

Fast-growth Shipium finds visibility into key metrics ‘worth its weight in gold’

When Geoff Tamman joined Shipium as its VP of finance and operations, he was acutely aware of the pitfalls that loomed if the startup labored ahead with QuickBooks while pursuing ambitious growth.

A likely scenario: extensive manual data work, limited visibility into key operating metrics, and a “Frankenstein” finance tech stack of bolt-on applications that would pile on high technical debt.

Geoff wanted to chart a more scalable financial management trajectory at Shipium, founded in 2019 as a provider of a SaaS-based enterprise shipping platform used by retailers, brands, 3PLs, and marketplaces.

“When I joined Shipium I was saying, ‘Hey, with the growth plans we have, I don’t think QuickBooks is the right solution,’” says Geoff, with two decades of experience in accounting, audit, and product management at companies including Amazon and Deloitte.

“I wanted to get ahead of the bow wave that was coming.”

Shipium finds ‘life Is a lot easier’ with Sage Intacct

With Sage Intacct in place, Shipium is realizing transformational gains in insights and efficiency that support its rapid growth.

“Life is a lot easier since we moved to Sage Intacct,” as Geoff tells me in a video.

“We have a holistic view across the business, and invoices automatically process because I set up the order schedules so customers have invoices the first of each month — I don’t have to touch it.”

Automated invoicing is accelerating cash flow because Geoff no longer has to spend time on tedious manual data chores.

“It’s not waiting on me to make time to ensure our invoices have run, which could cost us four or five days on cash flow timing,” says Geoff. “It leads to very predictable reporting.”

Along with speedier cash flow, Shipium is seeing greater accuracy in its cash forecasting.

The company is looking at a mere 1.2% variance from its operating plan over a full year — a remarkable achievement that underscores Shipium’s rigorous approach to financial management.

Reporting based on Sage Intacct dimensions, along with customized dashboards for executives, are giving Shipium the Holy Grail of real-time operating metrics that enable data-driven decision making.

“Every day, the executive team knows how we’re doing against our key operating metrics,” says Geoff. “That’s worth its weight in gold.”

A single system of record and key metrics such as net dollar retention, customer acquisition costs, and annual recurring revenue are delivering newfound confidence as Shipium grows.

“Strong finance hygiene based on strong financial systems allows me and other leaders to have a high level of confidence in our accuracy and reporting,” says Geoff.

“That leads to confidence in the company, confidence in the runway, confidence in our ability to drive cash.”